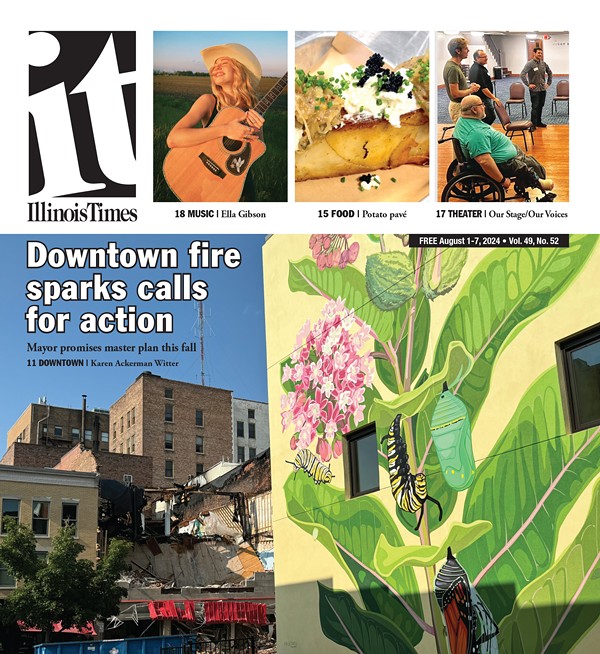

About the article: Governing magazine, based in Washington, D. C., covers state and local government across the country – the laws and leadership that shape the way states and cities serve their citizens. The magazine decided to devote attention to the ongoing issue of residential segregation in America, and how government policies continue to reinforce the racial divide between blacks and whites. Staff writer Daniel C. Vock, an Illinois native and a former Statehouse reporter in Springfield, began looking at the issue in several downstate Illinois cities. It’s easy to think of segregation as something most prevalent in the South, or in large urban areas. But parts of downstate Illinois are among the worst metro areas in the nation for residential and school segregation. Vock, along with Governing staff writer J. Brian Charles and data editor Mike Maciag, spent six months investigating and reporting this special series. Together with a photographer, the team spent a combined 20 days reporting on the ground in Illinois, including six days altogether in Springfield. This is an edited excerpt from Governing’s four-part series on segregation in downstate Illinois. For a link to the full article, go to illinoistimes.com.

This story is part of a series on segregation in Illinois that resulted from a six-month Governing magazine investigation. Part 1 appeared in Illinois Times Feb. 7 under the headline, “Segregated in the Heartland.”

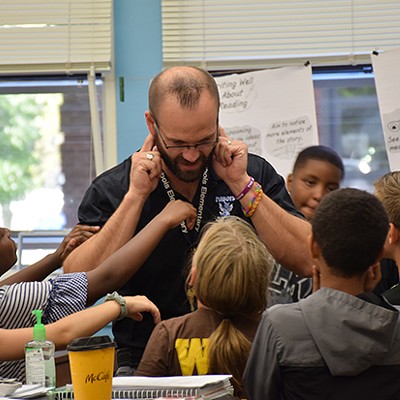

Lekiesha Hightower left Chicago for Springfield more than five years ago, hoping for a better life for herself and her child. Until this past May, she lived with a family friend in her new hometown, but last spring she moved into a place of her own, in the Poplar Place subdivision on Springfield’s east side.

Now that she’s in her own apartment, though, she finds herself dealing with the day-to-day hassles of one of the city’s most notorious neighborhoods. As she stands on the steps outside her duplex apartment on a September afternoon, Hightower points to shutters dangling off a neighboring building as an example of the poor state of repair in the 23-acre complex. Cockroaches are common, she says, and basic repairs -- even a fresh coat of paint -- are desperately needed in many apartments. Crime, from shootings to break-ins, is common.

“The owners don’t care,” says Hightower, a 39-year-old city youth services worker who, like most residents in Poplar Place, is black. “This is not my natural habitat. I didn’t stay in a place this bad in Chicago.”

The fact that Hightower finds herself renting an apartment on the east side of Springfield is no accident. A whole web of federal, state, local and even private regulations over housing and land use ensure that low-income residents live far away from wealthier ones, that apartment buildings are rarely situated next to single family housing and, as a result, that black residents and white residents largely live in different neighborhoods.

The system is so deeply ingrained, not just in Springfield, but in cities all over the country, that it is essentially taken for granted. It has deep roots in racial animus, going back to the days of redlining and racially restrictive covenants. The aftereffects of those policies linger on in the 21st century.

Today, the stated motivation for the existing arrangement is not race, but money. It’s why homeowners protest public housing projects or apartment buildings that could bring down their property values. It’s why subdivision developers sell homes with strings attached that keep neighborhoods homogeneous and unaffordable to lower-income residents. And it’s why Hightower’s rent, and the federal subsidies it generates, improve the bottom line for a multinational company headed by the owner of the Miami Dolphins.

Regardless of the motivation, the effect is largely the same: Cities and, indeed, entire metropolitan areas, remain largely segregated along racial lines.

Local governments help create those divides in several ways, but one of the most important is by regulating land use, especially residential development. The regulations include zoning restrictions, housing subsidies, tax incentives, public housing policy and restrictive covenants. None of them are necessarily discriminatory by themselves, but the way they are routinely used combines to create that effect.

A history of segregated settlements

The Midwest and Northeast have some of the most segregated metropolitan areas in the country. Much of their segregation traces back to when and how they were settled.

“Older industrial cities tend to have higher levels of segregation because they have denser housing and older housing in the core which filled up with black in-migrants from 1950-1970. [The city cores] then came to be surrounded by white suburbs covered by restrictive zoning policies,” explains Douglas Massey, a sociology professor at Princeton University.

Most of the cities in central and northern Illinois fit that pattern. Manufacturing and other heavy industries drew workers to the cities from the late 1800s through the mid-1900s. Caterpillar Inc., initially a maker of tractors, drew thousands of newcomers to its factories in and around Peoria. Decatur became known as the “soybean capital of the world” as it processed that crop, and many others, into consumer goods. Coal mining lured Irish and Eastern European immigrants, along with many blacks, to Springfield. And almost all of these communities, because of Illinois’ manufacturing base and strategic location at the center of the country, attracted railroads to service them.

By the 1970s, the industries that had fueled the growth of Illinois’ mid-sized cities were no longer booming. They faced increased competition from foreign companies, and many of their employers expanded to locations in the American South and West. The result is that population growth in the metro areas slowed, especially among whites.

The black population in those metro areas, though, continued to surge. Since 1970, the number of African-Americans in the Champaign-Urbana metro has nearly tripled. It has more than doubled in the Bloomington, Peoria, Rockford and Springfield metro areas. Since 1970, the white population for the Springfield metro area outside the city has increased about 11 percent, while it has remained about the same within the city. The total MSA white population has increased by about 5 percent. Over the same period, the black Springfield city population has doubled. As a whole, the metro area black population has also more than doubled, up 225 percent.

Both blacks and whites moved away from the traditional urban core in these cities but followed different patterns. Black residents tended to move into areas adjacent to traditional black neighborhoods (i.e. the places they had been confined to through redlining and other practices). Whites, on the other hand, leapfrogged out of the central city, often escaping city and school boundaries altogether. Wherever whites moved, commercial development and jobs followed. That type of investment was seldom seen in new or old black neighborhoods.

The continued racial sorting was not merely the product of people wanting to live with people like themselves. It was driven by policies making it difficult for minorities to live in predominantly white communities, specifically by making it difficult to rent there. Today, 62 percent of black households in Illinois rent their homes, compared with 27 percent for whites.

The wide gap was caused, at least in part, by discriminatory federal housing policy that dates back to the years before the federal Fair Housing Act of 1968, and in many cases to the period before World War II. During the Great Depression, Congress for the first time created federally guaranteed mortgages that were affordable to working-class homeowners. But the federal government, real estate agents and banks explicitly excluded blacks and black neighborhoods from those loans.

The loans helped whites build wealth by accumulating equity in their homes and taking advantage of the mortgage interest deduction for state and federal income taxes.

Black neighborhoods suffered because residents couldn’t get affordable loans to build, buy or renovate properties there. Existing houses fell into disrepair, and outside investors often bought them for rental units. And rent itself was a further barrier to minority residents who wanted to buy a home. That is still true. On the east side of Springfield, the predominantly black part of town where Hightower lives, approximately half of renters spend at least 50 percent of their paychecks on rent and utilities.

How white neighborhoods keep blacks out

It’s not just public housing that homeowners worry about when it comes to preserving their property values. They worry about siting industrial facilities and other less desirable businesses near homes and schools. That’s one reason why cities have put into place zoning ordinances to regulate land use. But, especially in smaller jurisdictions, apartment complexes and other multifamily housing are among the “undesirable” uses that homeowners want to keep at bay. The practical effect is often that predominantly white communities make it very difficult for black families, who are predominantly renters, to move in.

Take the Springfield area. The city of Springfield is not a solid mass sprawling out from the State Capitol complex downtown. It’s more like Swiss cheese. There are dozens of holes in its jurisdiction. Many of them are simply unincorporated areas of the county where residents never opted to join the city. There are also four villages entirely surrounded by the city: Grandview, Jerome, Leland Grove and Southern View. They also all happen to be significantly whiter than the Springfield neighborhoods that border them.

How did that happen? The short answer is that local ordinances basically prohibited any apartment complexes bigger than a duplex.

Three of the four villages were on the outskirts of Springfield in the 1930s. They incorporated in 1939 so they could sell bonds to connect their homes to Springfield’s new water system. The fourth village, Leland Grove, was created in 1951, so that residents of its hilly neighborhoods could build better roads.

But by incorporating, the villages also gained the authority to control land use, particularly through zoning. All came into being at a time when blacks were largely relegated to the east side of Springfield through redlining and, in some cases, racially restrictive covenants on deeds. When officials in those villages decided to “lock in” their existing character through zoning and other restrictions, they preserved for decades the land-use patterns of nearly all-white communities.

That effect is visible even today. The Village of Jerome, for example, is a collection of modest houses and strip malls just off Wabash Avenue, a main corridor between downtown Springfield and the city’s west side. The housing stock is mostly 1950s-era ranch homes along quiet two-lane roads with no sidewalks. Houses in Jerome these days go for around $100,000, making it a relatively affordable neighborhood.

Jerome’s zoning code, first drafted in 1963, puts severe restrictions on multifamily dwellings. Just two properties in the village have the necessary zoning to build a duplex or multifamily dwelling.

As of the 2010 Census, the village of 1,600 people was 89 percent white and just 4 percent black. Jerome’s racial breakdown is especially striking when compared to the area of Springfield directly to the south of the village, which is lined with apartment complexes. In 2010, that neighborhood was 60 percent white and 28 percent black.

“It is more restrictive density zoning in suburbs that makes the difference” in racial makeup between cities and their suburbs, says Massey, the Princeton sociology professor. “The lower the density allowed, the fewer housing units get built, and the higher the home prices. High home prices keep the poor out, of course, and because blacks and Latinos have higher poverty rates than whites, restrictive density zoning drives up racial as well as class segregation.”

But some things in Jerome may be changing, including its racial composition. Shirley Johnson, who is black, moved to the village four years ago. She said she fell in love with the craftsmanship of the woodwork in the house she now owns. She thought the new houses being built in Springfield were generically bland, and the touches on her house in Jerome reminded her of the houses she knew growing up in Chicago.

Johnson became a village trustee for Jerome two years after moving in. She says the village is going through significant turnover, as the owners who lived in the houses for decades either die or retire. “Now we’re seeing younger families and more transient families,” Johnson says. “We are seeing more African-American families, because these are great starter homes…My reception in the community has been great. I love how much it feels like a community. It’s like you’re in the country, but then you go back to Wabash and you’re back in the city.”

Springfield itself has used zoning to keep apartment complexes out of certain parts of the city, particularly on the far west side. Most of the land there is zoned for single-family housing. That designation can be self-reinforcing, since the city’s zoning ordinance requires the zoning commission to consider nearby land use and zoning when deciding whether to change a property’s zoning. In 2012, a group of west side homeowners moved to prevent the construction of apartment buildings near them by blocking the necessary zoning change. “There is no multifamily development for miles around,” they noted in their challenge. The homeowners lost that battle, and the apartments were built. But they are still the only apartments for miles around.

That’s a big reason why there aren’t many opportunities for low-income families to move to the west side. There are no two-bedroom properties that accept Section 8 housing vouchers west of MacArthur Boulevard, no public housing projects and only a handful of affordable housing units backed by state tax credits.

The growing power of Homeowners’ associations

The city of Springfield instituted its first zoning ordinance in 1966, and the rules for single-family homes remain largely the same today. They require lots to be 60 feet wide, with a minimum overall lot size of 7,200 square feet. Those lot sizes are small by today’s standards; nearby Chatham requires its residential lots to be 80 feet wide, with a minimum lot size of 12,000 square feet. The different standards help explain why Chatham (whose motto is “Family. Community. Prosperity.”) attracts richer residents than Springfield. But it doesn’t explain why homes on the west side of Springfield are so much more expensive than those on the east side. The same zoning rules for single-family homes apply throughout the city.

Those differences in housing costs are partially the result of another phenomenon: the resurgence of the restrictive covenant.

Restrictive covenants on land are infamous for their role in keeping cities segregated. The covenants forbade landowners in an area from selling their property to non-white buyers and set up neighborhood organizations with the power to enforce the prohibition. The U.S. Supreme Court ruled in 1948 that those arrangements were unconstitutional, although it took several decades before the practice was completely outlawed.

But the covenants themselves never really went away, and indeed are making a comeback, minus the racial language. Sixty-five percent of all new, single-family homes built for sale in the Midwest in 2017 were part of a homeowners’ association, up from 55 percent a decade prior to that. The numbers are even higher nationally: In 2017, 73 percent of new homes for sale in the U.S. were subject to the rules of homeowners’ associations.

Still, restrictive covenants only partially explain the disparities among Springfield’s neighborhoods. The racial makeup of certain areas of the city can be self-reinforcing. As long as white people largely avoid moving to the east side, the east side and its residents will inevitably lag behind in resources compared to their west side counterparts.

Consider Eastview Estates, a neat subdivision of houses built on the east side in the early 2000s. Its homes are covered by a restrictive covenant that’s enforced by a homeowners association. With its broad green lawns and minivans parked in two-car garages, the development looks like it could just as well be on the west side. Locals nicknamed it “Black Panther Creek” when it opened, a comparison to the swanky golf course subdivision out west and a nod to the fact that many prominent black residents of Springfield moved in. But the development ran into financial troubles, in large part because white homeowners weren’t interested in living there. The lack of interest is reflected in property values. This summer, a house with four bedrooms, 4.5 bathrooms and 2,400 square feet there sold in Eastview Estates for $124,500. A slightly smaller house, with four bedrooms, three bathrooms and 2,000 square feet, went up for sale on the white west side at roughly the same time. It had slightly nicer finishes, but it was located in a white neighborhood and included in a suburban – rather than the city’s – school district. It sold for $282,000, twice as much as the east side house.

A new way forward?

Eastview Estates is separated from Poplar Place, the long-neglected apartment complex where Lekiesha Hightower lives, by a set of power lines and a chain-link fence. No roads connect the two neighborhoods, which embody the stark contrasts of possibilities for the east side.

Springfield Mayor Jim Langfelder sees potential for Poplar Place, but he’s had to go back and forth with The Related Companies, the owner of the development, just to get their attention.

The long-running fight shows how frustrating it can be for city officials to improve local neighborhoods, especially when dealing with out-of-town landlords or powerful property owners. But it also shows how local officials can make improvements in spite of them.

Poplar Place has been a sore spot for Springfield officials for decades, but now Mayor Jim Langfelder has negotiated with the owners for a $20 million redevelopment plan. See sidebar on page 10.

Langfelder is looking at other means of improving the neighborhood, some of which are already underway. Five years ago, the school district opened a new elementary school a few blocks away. The city recently extended its tax-increment financing district for the area, which could potentially make more money available for infrastructure improvements.

The mayor thinks a major renovation could help the whole area around Poplar Place as well. The closest neighbors on either side of Poplar Place live in single-family homes, but much of the housing nearby is rental properties serving low-income residents. To the north a few blocks, there’s another project to renovate low-income housing in the works. A few blocks to the west sits a small public housing project. Near that, a nonprofit group called the Nehemiah Extension is building single-family homes for rent and eventually purchase by low-income residents. Several scattered-site homes owned by the housing authority are located nearby, too.

Individually, many of those efforts promise to improve conditions for residents in the area. But collectively, it’s hard not to notice that a lot of city, state and federal money is going to provide housing for poor and working-class people in the same small neighborhood, one that has the highest concentration of black residents on the east side. All that money, though, is linked to residents’ income levels. So even the new investments would essentially lock in much of the current makeup of the neighborhood for decades.

Poplar Place may get an overhaul

The poster child for east side decay is, arguably, Poplar Place, a housing development created in the 1940s. As years have passed, the development that includes more than 200 units, primarily duplexes, has fallen apart, with trash piling up and streets going unfixed. Because streets are owned by the complex’s owner, a Chicago-based firm, the city has been reluctant to repave roads and fix potholes with no guarantee of compensation from the development’s owner and no assurance that investments in streets would lead to investments in the buildings south of George Washington Middle School, not far from East Cook Street.

In February, the city agreed to spend $1.2 million in tax increment financing funds to fix the roads, but it’s not a sure thing. City money is contingent on improvements to buildings, which has been proposed by Iceberg Development, an Iowa company that is seeking financing with the help of Lightengale Group, a Chicago firm that specializes in finding money for affordable housing. Under the plan, the bulk of the money for a $22 million overhaul would come in the form of tax credits awarded by the Illinois Housing Development Authority. Virginia Pace, Lightengale president, said she expects a decision from IHDA by early June.

Under the plan, the number of units would be cut to 99 dwellings, including 77 single-family homes. If all goes well, construction would begin in December, Pace says, and continue for between 14 and 16 months. The good news, she says, is that the buildings were built well and so are good candidates for rehabilitation.

“They’ve got good bones,” Pace says.

–Bruce Rushton